Comments aren’t just noise under your posts. They’re high-effort, public signals that your content struck a nerve, your brand feels approachable, and your audience is willing to spend time with you. Done right, comment activity predicts future reach, lowers acquisition costs, and seeds a durable community around your brand.

The engagement ladder (and where comments sit)

Think of engagement in tiers:

- Passive: impressions, views

- Light: likes/reactions, lightweight clicks

- Mid: saves, shares, link clicks

- High-effort: comments, replies, user stories, UGC

Algorithms and humans both weight the top tier more. A single thoughtful comment can be worth dozens of likes because it shows intent, not just approval.

Five dimensions to assess comment quality

Stop reporting “total comments.” Measure these five lenses instead:

- Volume

How many people speak up at all?

- Comment Rate:

unique commenters ÷ reach(or per 1,000 impressions) - Reply Rate:

replies ÷ parent comments

- Depth

Are there conversations or just one-offs?

- Discussion Depth: average replies per thread; max thread depth

- Back-and-forth ratio: % of comments that receive a reply from you or peers

- Quality

Do comments move the business forward? Classify each into:

- Questions (buying, product, how-to)

- Insights/Stories (use cases, outcomes)

- Ideas/Requests (features, topics)

- Praise/Critique (sentiment)

- Low-effort (emoji/“nice”)

Quality Mix: % of high-intent comments (questions, stories, ideas) vs low-effort.

- Continuity

Is engagement recurring or episodic?

- Returning Commenters (30/90 days):

repeat commenters ÷ all commenters - Cohort retention: share of a month’s new commenters who comment again in the next month

- Influence

Who’s engaging?

- Segment share: customers, prospects, partners, creators, employees

- Peer-to-peer replies: % of responses between audience members (a sign of true community)

Add two service metrics:

- Brand Response Coverage:

% of questions that receive a brand reply - Median Response Time: from question to brand answer

What the signals actually mean

- Lots of questions → Content-market fit, but clarity gaps remain. Create follow-ups, FAQs, and demo snippets.

- Stories and use cases → Trust is forming. Mine these for testimonials and case-study angles.

- Product ideas/requests → Free research. Tag, count, and review monthly with product/merch teams.

- Critiques with specifics → Early warning on friction (pricing, onboarding, UX). Close the loop publicly when fixed.

- Peer support → The community is helping itself; elevate power users and formalize advocacy.

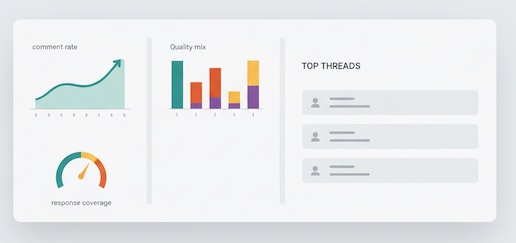

A simple weekly executive snapshot

Keep it to one slide:

- Reach & Comment Rate: trend vs. prior 4 weeks

- Quality Mix: % questions / stories / ideas / low-effort

- Continuity: returning commenters (90-day)

- Brand Service: response coverage and median response time

- Top Threads: 3 most business-useful discussions (with takeaway and next action)

- Risks: emerging negative themes and plan to address

Benchmarks (directional, not universal)

- Comment Rate: 0.3–1.0% of reach on paid social; 0.5–2.0% on organic LinkedIn/Instagram; forums and communities can be much higher.

- Discussion Depth: ≥1.5 replies per parent comment indicates conversation, not applause.

- Quality Mix: Aim for ≥40% high-intent comments over time.

- Response Coverage: ≥90% of questions answered within 24 hours on business days.

Use trends and peer set comparisons; absolute numbers vary by niche and channel.

Avoid the vanity traps

- “Applause trap.” Lots of compliments, no questions or ideas, often means entertainment over utility. Balance formats.

- Engagement pods/farmed comments. Easy to spot: generic praise, no topic specificity, identical timing. They inflate KPIs and erode trust.

- Sentiment whiplash. A few loud negative comments can dominate perception. Use normalized sentiment (per 100 comments) and categorize by theme before reacting.

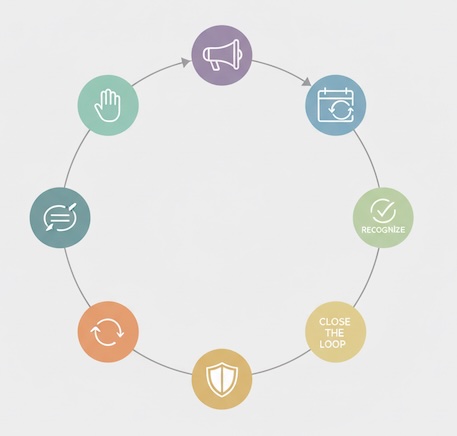

Turn comments into a community flywheel

- Invite: Ask specific, answerable prompts (“What nearly stopped you from buying? One sentence.”).

- Respond: Acknowledge, answer, and link to the next step (post, resource, doc).

- Elevate: Feature the best comments in carousels, newsletters, or product docs (with permission).

- Close the loop: When you ship a fix suggested in comments, tag the original commenter publicly.

- Recognize: Create lightweight recognition (badges, early access, “top contributor” shout-outs).

- Ritualize: Run recurring threads (Monthly Q&A, “Show your stack,” “Feature Friday”) so participation becomes a habit.

What to post to earn quality comments

- Contrarian but useful takes (e.g., “When not to use our product”).

- Work-in-progress ideas (roadmap sketches, draft templates) to invite co-creation.

- Specific questions tied to decisions (“Which KPI would you drop from a one-page report—and why?”).

- Customer stories with open loops (“This healthcare team cut onboarding time by 37%—want the playbook or the dashboard template next?”).

B2C vs. B2B nuances

- B2C: Volume is higher, low-effort comments common; prioritize quality mix and rapid moderation.

- B2B: Volume is lower, but influence is higher; prioritize who is commenting (titles, accounts, partners) and discussion depth.

Handling tough threads without fanning flames

- Acknowledge first, fact later. “You’re right, that’s frustrating. Here’s what we’re doing…”

- Move 1:1 only when needed. Summarize the resolution publicly after the private fix.

- Set boundaries. Remove hate, slurs, doxxing. Critique is fine; abuse isn’t. Publish clear guidelines and apply them consistently.

From comments to business value

- Content roadmap: Tag comment themes (“pricing confusion,” “setup step X”). If a theme repeats, ship a post/video addressing it.

- Product backlog: Quantify feature requests by count and account value; share a top-5 list with product monthly.

- Advocate pipeline: Identify repeat high-quality commenters for beta programs, testimonials, or referral loops.

- Attribution hinting: Track whether commenters are more likely to convert later (a simple audience tag can reveal a lift, even without perfect attribution).

Bottom line: Comments are not a vanity metric; they’re proof of attention, intent, and trust. Measure who speaks, what they say, how deep the conversation goes, and whether they come back. Respond visibly, elevate community voices, and close the loop on feedback. Do this consistently and engagement stops being an afterthought—it becomes a durable moat for your brand.